Liability insurance Netherlands

Most Dutch inhabitants have a liability insurance. With this liability insurance you are covered against damages that you have caused (unintentionally) and that you must compensate. It is however, not mandatory to take out liability insurance in the Netherlands, like most people think. According to recent research around 87% of the Dutch insurance have this insurance because in Dutch law you are responsible for the damage you do to another person. This can be caused by accident or by a mistake – not on purpose.

Liability insurance explained

The process

You are responsible for any damages you do to another person by Dutch law – it does not matter if this was by accident or by mistake. You can however, protect yourself for these damages by taking out a liability insurance. In this way you protect yourself against financial compensation for those damages. Your liability insurance company will deal with a claim if you unintentionally cause damage to another person. This will give you peace of mind, since you don’t have to deal with the paperwork and money yourself. The only thing that you must do is to contact your insurance company and explain the situation – they will handle the rest.

Sorts of coverage

So, what is actually covered by a liability insurance in the Netherlands? You have 3 types of damages: mental, material and physical. The following kind of costs are covered: the completion of the claim, the legal proceedings and the research of the expert. Most Dutch insurance companies will also cover damages caused by pets, but be sure to double check this when you take out the insurance. This can differ between insurance companies.

What will be the premium for liability insurance in the Netherlands? This depends mostly on 3 factors: your family situation, the amount of money you choose to cover and the amount of excess you choose (excess in the amount of the potential claim that you must pay yourself). You can ask for a quotation online.

List of liabilty insurance companies in the Netherlands

So, what is the best liability insurance company in the Netherlands? This is difficult to say since every insurance company offers different premiums and different options. We have listed below the most frequently used liability insurance companies in the Netherlands.

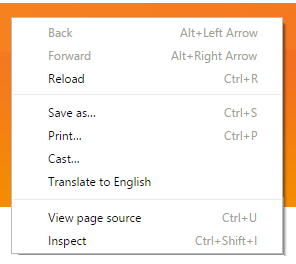

If you land on the website of an Dutch liability insurance company (which is often in Dutch), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.

If you land on the website of an Dutch liability insurance company (which is often in Dutch), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.| Cheap | Quality | Packages* | |

|---|---|---|---|

| Centraal Beheer | ✓ | ✓ | ✓ |

| ABN AMRO | ✘ | ✓ | ✓ |

| Inshared | ✓ | ✓ | ✘ |

| Univé | ✓ | ✓ | ✓ |

| Hema | ✓ | ✓ | ✓ |

| Ditzo | ✓ | ✓ | ✓ |

These insurers all offer different options and packages which vary in price and quality. Comparing all liability insurances in the Netherlands can be time-consuming for expats. We have listed the most reliable liability insurance companies below. All these insurance companies are trustworthy and offer professional liability insurance in the Netherlands.

The best liability insurance in the Netherlands

Univé liability insurance

Univé is one of the biggest insurance companies in the Netherlands and can therefore offer a cheap liability insurance, compared to other companies. Univé is a non-profit insurer and their business model is not focussed on making profit. Univé covers damages up to €2.500.000,- and you can choose to have no excess amount (the amount of the potential claim that you must pay yourself) . This insurance (in Dutch: WA – ‘Wettelijke aansprakelijkheid) covers you wherever you go in the world. This can come in handy if you plan on doing a lot of traveling this year. You can easily get a quotation from Univé online.

Univé is one of the biggest insurance companies in the Netherlands and can therefore offer a cheap liability insurance, compared to other companies. Univé is a non-profit insurer and their business model is not focussed on making profit. Univé covers damages up to €2.500.000,- and you can choose to have no excess amount (the amount of the potential claim that you must pay yourself) . This insurance (in Dutch: WA – ‘Wettelijke aansprakelijkheid) covers you wherever you go in the world. This can come in handy if you plan on doing a lot of traveling this year. You can easily get a quotation from Univé online.

Centraal Beheer liability insurance

Centraal Beheer is an excellent insurance company and their liability insurance is one of the best in the Netherlands. You can choose between an insured amount of € 1,5 and € 2,5 million euro.. The Centraal Beheer insurance also covers damage caused by your pets and damage you cause to others (unintentionally). They offer a broad liability insurance which covers more areas than other insurance companies do. This liability insurance applies to you and the people whom you are living with (partner or children). Also, you are insured anywhere in the world. This insurance however, costs a bit more than the Univé liability insurance, but in return you will be insured for more types of damages.

Centraal Beheer is an excellent insurance company and their liability insurance is one of the best in the Netherlands. You can choose between an insured amount of € 1,5 and € 2,5 million euro.. The Centraal Beheer insurance also covers damage caused by your pets and damage you cause to others (unintentionally). They offer a broad liability insurance which covers more areas than other insurance companies do. This liability insurance applies to you and the people whom you are living with (partner or children). Also, you are insured anywhere in the world. This insurance however, costs a bit more than the Univé liability insurance, but in return you will be insured for more types of damages.