Car insurance in the Netherlands

It is always difficult to understand the rules and regulations surrounding car insurance when moving to another country. We have made a simple overview to make sure everything goes according to plan. All car insurance companies in the Netherlands provide good coverage, are reliable and provide good customer service. All car insurance companies offer different premiums, conditions, and coverages. Comparing car insurances in the Netherlands can be time-consuming. With our tips, we will ensure, that you will sign-up for the best car insurance in the Netherlands.

Obliged by law, every car owner in the Netherlands should have car insurance. Though it is mandatory, it works in your interest, as it protects against damage, theft, or collision costs. Which otherwise could turn out to be very expensive. Comparing car insurance can become a time-consuming task in the Netherlands. Here are the top two car insurance companies. If you are new to the country, or just owned a new car, selecting the one can become easy for you.

Car Insurance explained

List of Dutch insurance companies

So, what is the best car insurance in Holland? This question is hard to answer since not everybody needs the same car insurance. If you have an older car- third party liability should be sufficient. If you have a new car and you drive often through the small streets of Amsterdam, then you should consider starting a WA Plus or All risk insurance. You pay a bit more, but it will give you peace of mind. We have listed below the most frequently used insurance companies in Holland.

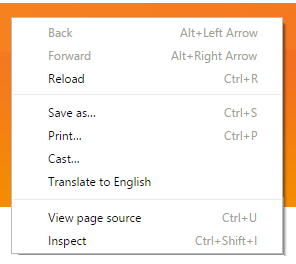

TIP: If you land on the website of an Dutch car insurance company (which is often in Dutch), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.

If you land on the website of an Dutch car insurance company (which is often in Dutch), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.

| Cheap | Quality | Packages* | |

|---|---|---|---|

| Centraal Beheer | ✓ | ✓ | ✓ |

| Univé | ✓ | ✓ | ✓ |

| Inshared | ✘ | ✓ | ✘ |

| ABN AMRO | ✘ | ✓ | ✓ |

| Nationale Nederlanden | ✓ | ✓ | ✘ |

| ANWB | ✘ | ✓ | ✘ |

| Delta Lloyd | ✘ | ✓ | ✘ |

| Ditzo | ✓ | ✓ | ✘ |

| Aegon NL | ✓ | ✓ | ✓ |

These insurers all offer different options and packages which varies in price and quality. Comparing all car insurances in the Netherlands can be time-consuming for expats. We have listed the most reliable auto insurance companies below. You can easily request a car insurance quote from one of these companies. All these Dutch car insurance companies are trustworthy and offer the best coverage.

Legal issues

Every Dutch resident who owns a car is obliged to take out a car insurance. The minimum coverage is third-party liability car insurance. The other two other car insurance options are WA Plus or All Risks coverage. If you have a relatively new car or an expensive car model it would make sense to go for one of the last 2 options. There are some legal issues to keep in mind before taking out a car insurance. For example; only a vehicle with a Dutch license number can be insured. Therefore, you need to live permanently in the Netherlands. Moreover, you will need a European driving license. If you have obtained this driver’s license within the EU, it shouldn’t be a problem to get your car insured.

Sorts of coverage

There are different sorts of insurances that all offer different coverage. Not everybody needs to have the same insurance. We have explained below the different sorts of insurances and what they cover:

1. Third party liability insurance

Third party liability means ‘WA – Wettelijke Aansprakelijkheid’ in Dutch. Third party liability only covers the damage that you inflict with your car to other people and their property. It will provide coverage if you have an at-fault accident (you caused the accident to take place). Third liability will cover in case you injure or kill someone, or you damage someone else’s property (house, garden, pool, fence etc.)

2. WA Plus insurance

WA plus includes third party liability insurance but also includes coverage for damage to your own car. In general, damages are covered by WA Plus resulting from vandalism, theft, storm, fire, and damage resulting from a collision with animals or birds.

3. All Risk insurance

All risk car insurance (full casco insurance) is a full coverage insurance, which provides from all insurances the most exhaustive coverage. It covers the same aspects that WA plus covers, but it also covers damages to your car even if it is by your own fault. It covers the damage even if you get in in an accident that was deemed your fault or when fault can’t be determined.

You can easily use a car insurance calculator if you simply want to know what the price is for a car insurance in the Netherlands.

The best car insurance in the Netherlands

Centraal Beheer

Counted among the top car insurance companies, Centraal Beheer is one of the oldest and reliable car insurers in the Netherlands. Their clear contracts are easy to understand, and they are also backed by excellent customer service. If you are looking for quality service, Centraal Beheer would be a perfect pick for you. The company provides you with four types of car insurance packages. Select the one that suits your requirements and keep your car well-insured when on the road.

Counted among the top car insurance companies, Centraal Beheer is one of the oldest and reliable car insurers in the Netherlands. Their clear contracts are easy to understand, and they are also backed by excellent customer service. If you are looking for quality service, Centraal Beheer would be a perfect pick for you. The company provides you with four types of car insurance packages. Select the one that suits your requirements and keep your car well-insured when on the road.

WA – It is the simplest car insurance by Centraal Beheer that covers the damages caused to the other vehicles. Your car is insured at a very competitive price. For little or no damage, you will get a discount of 75% on the premium. If you go for a higher deductible, again, it will be covered at a discounted price. At any time, you can cancel your WA car insurance and extend it to All Risk or WA + Limited Casco car insurance.

- € 6,500,000 cover for the damage caused to other people

- € 2,500,000 coverage for damage caused to someone else’s stuff

- Assists you if you are unable to drive after an accident

- Covers the cost of a lawsuit

WA + Limited Casco – This car insurance is preferred for cars that are between 6 to 10 years. It covers the costs for the damage caused to your car as well as others. If your vehicle is lost or stolen, the package covers the purchase price up to three years. Your car accessories are also included in this. If you get your car repaired from the Centraal Beheer repairer network, you will receive 4-year FOCWA / Bovag guarantee, discount on premium, and also free replacement transport.

You can select from € 0, € 150, or € 300 deductible. The higher your deductible cost is, the cheaper will be your car insurance.

- Along with covering WA package costs, it includes damage caused to your car

- Burglary and theft

- Damages from natural occurrences like fire, storm, etc.

All Risk – It is the most comprehensive car insurance that covers almost all the features as WA + Limited Casco. Along with that, it also includes the costs if your car is damaged by vandalism.

With a VBV approved vehicle tracking system, your car is insured for theft. For this, the catalog value of the vehicle should be €75000 or more and should also not be more than 5 years older.

- Along with the WA + Limited Casco features<- it includes vandalism and crash damage

- Compile yourself – Centraal Beheer even gives you the option of compiling your car insurance as per your requirements. You can pay for only that you find essential.

Univé

The well-known car insurance company is one of the largest car insurers that provide insurance at very affordable rates. Univé works with a non-profit objective, which is the reason for their higher customer satisfaction rate. You will get three types of car insurance here.

The well-known car insurance company is one of the largest car insurers that provide insurance at very affordable rates. Univé works with a non-profit objective, which is the reason for their higher customer satisfaction rate. You will get three types of car insurance here.

WA Legal liability – It reimburses the damage caused to other persons and goods. But does not cover the damage caused to you and your vehicle. This insurance package is usually for nine years and older cars.

- € 6,100,000 coverage for injuries to other persons.

- € 2,500,000 for material damage to other people.

WA + Limited Casco – In addition to the damages caused to other people and their property, this insurance package also covers the costs of your injuries and car damage. The standard deductible here is €100 and can be increased to €500. This insurance cover is for cars 6 to 9 years old.

- Along with WA Legal liability costs, damage to your car from an accident or natural calamities is also covered

- New value guarantee for 1-year that is extendable up to 3 years

- Purchase value guarantee of 3-year for 5-year and younger cars

All Risk Fully Casco – The comprehensive car insurance policy for vehicles that are up to 6 years old. Along with mandatory liability coverage, it reimburses the costs of damage caused to your car. The deductible costs are the same as WA + Limited Casco package.

- Includes all costs of WA + Limited Casco package along with vandalism costs

The replacement and purchase value in WA + Limited Casco, and All Risk Fully Casco are valid for the accessories and catalog value of €85,000. This scheme is valid only on purchase invoices from BOVAG company or a brand dealer.

Independer

You can compare car more than 75 car insurance from almost 50 insures. This helps you view their products and more information about their services. Compare and connect to the best car insurance.

You can compare car more than 75 car insurance from almost 50 insures. This helps you view their products and more information about their services. Compare and connect to the best car insurance.

Steps for capering car insurance at Independer:

- Fill your details

- Select the car insurance coverage

- Pick the cheapest car insurance

- Choose additional coverage

- Fill in the address and other required details

- Agree to the terms, and your car insurance agreement becomes valid immediately

Car insurance checklist

We have listed a checklist to ensure that you will find the right auto insurance in the Netherlands. To make sure that the sign-up process goes as smooth as possible you should have the following things at hand:

- The number plate of your car

- The number of years of no-claims discount

- Your full address

- You date of birth

The process

Once you have found the right Dutch car insurance you can fill in your number plate, your zip code, date of birth and the number of years of no claims discount. In the second step, you can choose the coverage that you want. You can also choose additional coverages. The website of the car insurance company will calculate your premium once you have filled in the questions and chosen your coverage. If you agree with the conditions and terms of the contract your car insurance is valid immediately. You will receive a confirmation by email once you have taken out the insurance. You will get a certificate of insurance (policy) the following day and after 2 days you will receive the green card.