Loans in the Netherlands

Have you moved to the Netherlands, the land of tulips, canals, windmills, and various cycling routes? Are you planning to buy a home or car or other household appliances to lead a stable life in the new country? If you are falling short of savings, you can make the things affordable with the Dutch loans.

Dutch banks offer you different types of loans – personal, car, business, long-term, short-term, and various others. Financial support in the new country allows you to live a comfortable life in the Netherlands. Are you wondering now how to get a loan in the Netherlands? Well, the process is not that hard, but you need to fulfill certain conditions to become eligible and get your loan approved.

Whether you are applying for an offline or an online loan in the Netherlands, these are some requirements that need to be fulfilled. You can also use loan calculator Netherlands to apply with the right loan amount so that you can clear the debt easily and quickly.

Loans explained

Eligibility to apply for the loan:

- To apply for a loan in the Netherlands you need to be at least 18 years of age.

- You must have a valid identity proof.

- A secure income in necessary to apply for a loan. The bank can ask for income proof and even your employment contract.

- If you have recently moved to the country, then you might need to wait as the loans are granted only to people with a history of at least three years of employment in the Netherlands.

- If you are not from the EU, then a permanent residence permit will also be required.

Loan providers

So, what are the best loan providers in the Netherlands and which of them offers the best terms and conditions? We have listed below the most frequently used providers in the Netherlands.

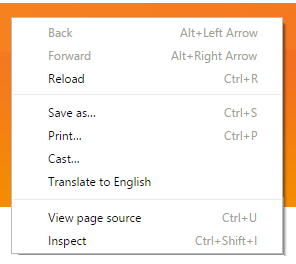

If you land on the website of an loan provider company (which is often in Dutch), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.

If you land on the website of an loan provider company (which is often in Dutch), make a right mouse-click anywhere on the page (this only works with Google Chrome!). A small dropdown menu will appear and then it will say; “translate this page to English” (or any other language). This will make it better understandable and easier for you to make the right decision.Be aware that Borrowing money costs money

| Cheap | Good Terms | Low Interest rate | |

|---|---|---|---|

| Santander | ✓ | ✓ | ✓ |

| Saldodipje | ✓ | ✓ | ✘ |

| Kredietspotter | ✘ | ✓ | ✘ |

| A-krediet | ✘ | ✓ | ✘ |

| Becam | ✘ | ✓ | ✓ |

Why opt for a loan in the Netherlands?

Taking a loan is a prototypical thing in the Netherlands like in most other countries. Here, you can take loans for various reasons, including

- For emergency cash assistance, including paying past-due home payments and utilities, medical bills, funeral expenses, etc.

- For repaying the money taken as debt.

- For buying a home or repairing and remodeling it.

- As moving costs when you move from one place to other.

- If you are looking for buying or leasing a new or used car.

- To cover your wedding expenses.

- For purchasing major electronic gadgets, house appliances, and other big necessary household items.

- For studying in a high school, college, or university.

So, these were some reasons for which you can opt for a loan in the Netherlands. Contact your nearby bank or a lender if you also want to get your hands on any type of loan.

Personal and private loans

Personal loans are popular in the Netherlands. Whether you wish to buy a house or renovate it or need funds to arrange a wedding, etc. getting a personal loan can help achieve all your goals. A personal loan comes with a fixed interest for a fixed term.

When you are applying for a home loan in the Netherlands, you agree on the amount and the term in which you can repay the loan in advance. The loan calculator in the Netherlands helps you in getting a better idea about the monthly payment, interest amount, and term in which the entire loan amount can be repaid. The moment you repay your fixed monthly installment with the interest amount, it gets debited from your bank account.

You must be thinking about how to get a loan in the Netherlands. The complete process of personal loans in the Netherlands for expats quick and simple. But you need to fulfill the below eligibility criteria to get your personal loan in the Netherlands approved:

- Under the Dutch employer’s contract, you should be working in the country for the last three years. However, if you are self-employed, even then your business needs to be active from the previous three years.

- Whether you are applying for an offline or an online loan in Netherland, your credit history needs to be positive.

- For non-Europeans, a residence permit is vital.

Car loan in the Netherlands

Car loan in the Netherlands helps you get the car of your dream easily. Just select the right loan amount and the term to get your dream car financed.

Things to consider while applying for auto loans in the Netherlands:

- Fulfill the eligibility conditions like your age, salary, employment history, and residence permit.

- When you buy a car on a loan, your vehicle acts as collateral for your loan amount. If you fail to repay the amount, the lender can seize your asset. So keep your term short that you can afford easily.

- Check your credit score before applying for the car loan. The higher your credit score, the better will be the interest rate.

Different Dutch banks offer you a loan with varying rates of interest. Compare car loans with various banks and apply them with the one that meets your requirements.

Be aware that Borrowing money costs money

Advantages of online loans in the Netherlands

If you are looking for extra expenses such as for the wedding, home improvement, or want to go on a lavish vacation, you don’t want to make trips to banks. If yes, you can opt for the online loan application in the Netherlands. The online market will provide you with several types of loans you can apply for as long as you qualify.

One of the primary benefits of online loans is that you can check the best loans according to your needs and financial situation. Most lenders will let you compare the loans with other accessible loans. With this, you can make the right choice and choose the best loan for you.

Many digital lenders will provide pre-approval to see whether you are eligible for the loan you want. In this process, the lender will look at the past relationship between the lenders and credit worthiness. If approved, you can easily secure the loan for your personal use.